WeBC proudly presents this insightful report, highlighting the findings of a survey conducted with over 400 women business owners in November 2020. The survey explores the funding women entrepreneurs need, their ability to access it, and the support that can help them during COVID recovery and beyond.

Recent studies reveal the disproportionate impact of the pandemic on women entrepreneurs, threatening the progress made in advancing women’s entrepreneurship in Canada.

As economic recovery takes shape, funding plays a critical role in supporting the unique needs and growth pathways of women entrepreneurs.

This report offers actionable insights for funders and ecosystem partners to refine their strategies and funding models, building a stronger pipeline of diverse, thriving women-owned businesses driving Canada’s economy forward!

In This Report

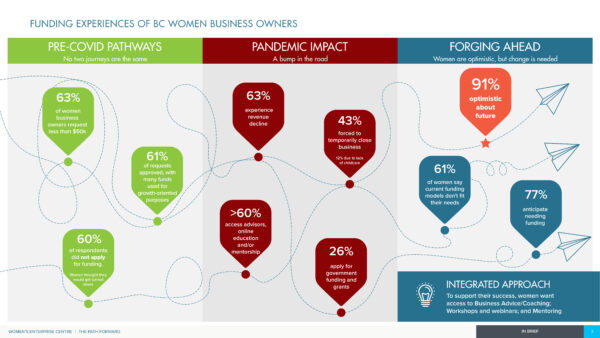

- The funding experiences of women business owners Pre-Covid: who they approached for funding, their funding outcomes and roadblocks

- How the pandemic has impacted women business owners and their ability to access capital

- How women business owners feel about the future, their aspirations and funding needs

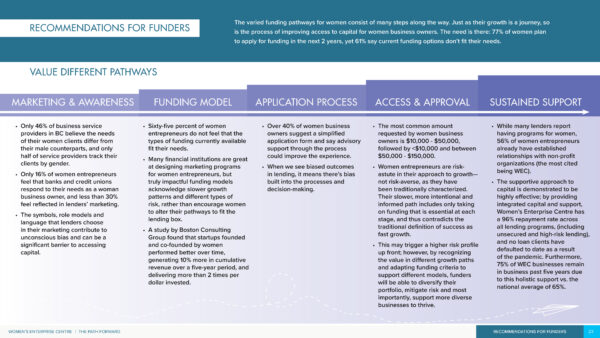

- Recommendations for funders to redesign each step of their funding models

Key Findings

- THE PANDEMIC HAS STALLED OUR PROGRESS. In recent years, women-owned businesses have increased their impact in terms of exporting, growth, innovation and social impact; yet, the pandemic is disproportionately affecting women and we’re losing ground on recent progress.

- SMALL LOANS = BIG DIFFERENCE. Sixty-three percent of women request less than $50K, but this doesn’t mean they have small plans. In fact, many women use funds for growth purposes and they tend to choose an intentional and informed path to funding.

- EARLY STAGE FUNDING IS CRITICAL FOR FUTURE GROWTH. Building positive relationships with the lending ecosystem early on can improve access to capital long-term.

- NEW FUNDING MODELS ARE NEEDED TO ENCOURAGE DIVERSITY AMONG ENTREPRENEURS. Sixty-one percent of women say current funding models don’t fit their needs. About one-third of requests for Non-WeBC funding in the past three years were declined, and 28% of Non-WeBC-Funded women have not applied for funding because they feel they wouldn’t qualify.

- THE CURRENT APPLICATION PROCESS NEEDS AN UPGRADE. Over half of respondents find the process of applying for [Non-WeBC] funding to be somewhat or very difficult, while 77% of WeBC-Funded women say the WeBC loan process is somewhat or very easy. Over 40% recommend business advisory support to complement a simplified application form by Non-WeBC WeBC lenders.

- GROWTH MINDSET IS STRONG. Over 90% of women entrepreneurs are optimistic about the future, and nearly 80% plan to apply for funding in the next two years. Many are focused on attracting new customers and enabling growth, and 47% expect to hire new employees in the near future.

- WOMEN PREFER AN HOLISTIC APPROACH. Capital + support is proven to decrease barriers in the application process, have stronger outcomes and help women over bumps in the road—but funders don’t need to create new support programs from scratch. The majority of women business owners already have established relationships with support organizations, so funders can leverage those existing relationships. An example of this collaborative approach is the Unity Women Entrepreneurs Program, a collaborative pilot program developed by Vancity and WeBC.

Our Approach

For this study, our aim was to:

- Understand the past (Pre-Covid), present (Covid) and future funding journeys of women entrepreneurs in BC, so we can identify gaps and opportunities to support their future needs; and

- Compare the experiences of WeBC loan clients to those of women who access funding elsewhere or self-funded their businesses, to see if our loan model improves business outcomes.

We surveyed over 400 women business owners to learn about their funding experiences over three time periods: the past three years prior to March 31, 2020 (Pre-Covid); from April 1, 2020 to November 1, 2020 (During Covid); and looking ahead to the next two years.

Then, we contrasted the experiences of WeBC-Funded women with those of women who sought funding elsewhere or self-funded their businesses.

How Development Lending Clears the Path for Women Entrepreneurs

Our research has shown that women who access funding from development lenders, like WeBC, develop more positive relationships with the lending ecosystem, are better supported through the application process and have a greater chance of long-term success.

Here, we share two real-life perspectives on development lending.

Lender Perspective: An integrated approach to capital

Featuring Mahsa Arbabi, Co-Owner of Candiz Food Group and Canadian Co-Packing, and WeBC Loan Client

Client Spotlight: The benefit of tailored funding

Featuring Vivian McCormick, Co-Owner of Flax Sleep and Former WeBC Loan Client