Whether you’ve done your business planning in a formal written document, on scraps of paper, or if you have your ideas in your head, it’s important to tell the story and then translate it into numbers on your cash flow statement.

There are many factors that impact your cash flow. But, to get started, here are six key questions that can help you estimate the size and timing of your inflows and outflows:

Revenue

a. What is the revenue model in your business?

Examples: sale of product, monthly subscriptions, hourly rate for a customized service, commission, franchise or license fees, etc.

b. How consistent does this revenue model make your cash inflows?

For example, a monthly subscription model has a relatively consistent cash inflow while invoicing for a customized service might vary greatly from month to month.

Market Potential

a. What type of market are you operating in? Pick one of the descriptions below.

- An existing market where your revenue growth matches your marketing and sales expenses and effort.

- A new market where you will have to educate customers first and revenue will follow the adoption curve.

- Other: Perhaps the market is changing so there is some education required and then you expect sales will grow in line with your marketing.

Target Market

a. Are you marketing your business to other businesses (B2B), directly to consumers (B2C) or both?

b. Can you describe your typical customer?

Profit Potential

a. Do you know the selling price and cost of producing one unit?

Examples: the ingredients of a sandwich cost $3 and you can sell the sandwich for $10; designing the brochure takes 5 hours at a total labour cost of $250 and you invoice the client $450.

Your Goals and Cash Flow

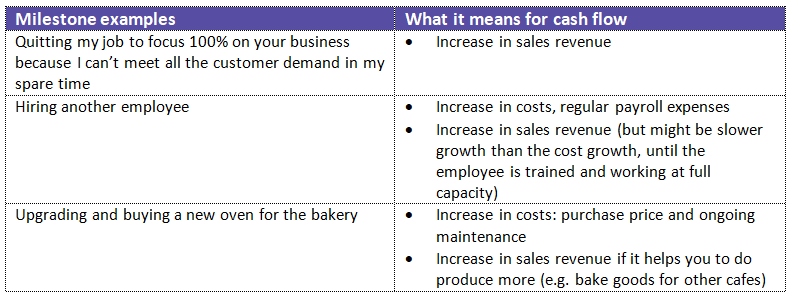

Next, identify three changes (milestones) that will happen in the next 1-3 years. These milestones can then help you to see when you might have a rise in revenues or a rise in costs. It will also show the pace of changes.

Once you’ve identified the milestones then you can draw the revenue and cost lines to reflect what the impact is of the activity in the milestones.

Sample Cash Flow Milestones

If you need help to answer some of these questions, check out the Business Model Canvas by Strategyzer.